Building on previous work with The Council of

the District of Columbia's Office of Racial Equity (CORE) to examine the racial wealth gap in

Washington, D.C., MITRE has developed a household finance model to learn more about how racial inequity

impacts wealth and to help users answer questions about the wealth gap. In a previously published report

(The Racial

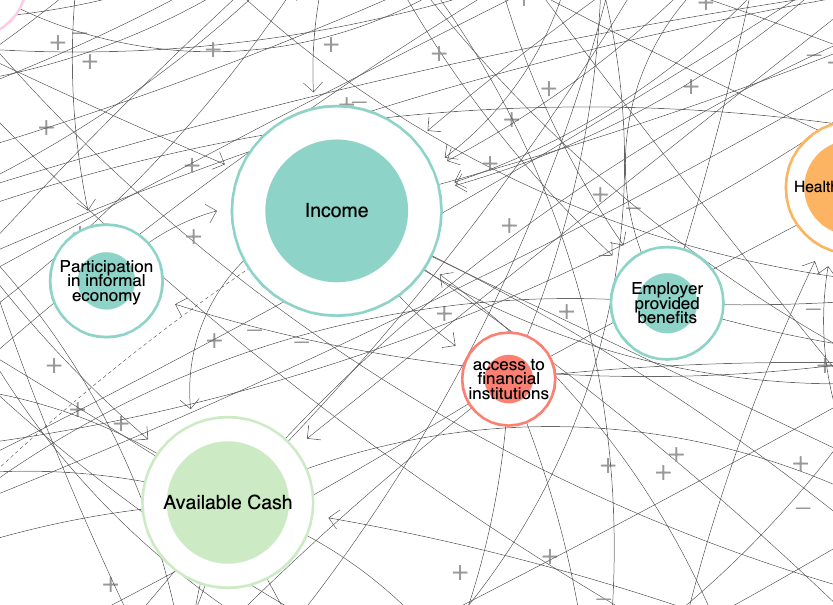

Wealth Gap in Washington, D.C.), we mapped a wide range of factors that influence wealth building,

and provided context from research on the historical oppression, ongoing policies, and inherited inequity

that contribute to the racial wealth gap. The report resulted in several follow-on questions, including:

- How do factors that influence wealth building impact residents and households?

- What proposed interventions may influence the bottom line for residents?

This model can help us understand the dynamics of the racial wealth gap, and in conjunction with community

design can support evaluating the financial impact of proposed policies and interventions.

The median net worth of a white household is 81 times that of a Black household in D.C.

1

While community and cultural assets play a critical role in supporting Black households in D.C., this

wealth disparity leads to an uneven financial foundation with wide-ranging and long-lasting impacts. Some

questions this model seeks to help answer include:

- What financial, social, and historical factors led to this racial gap in net worth?

- Is the gap widening or shrinking?

- How would different financial policies affect the gap?

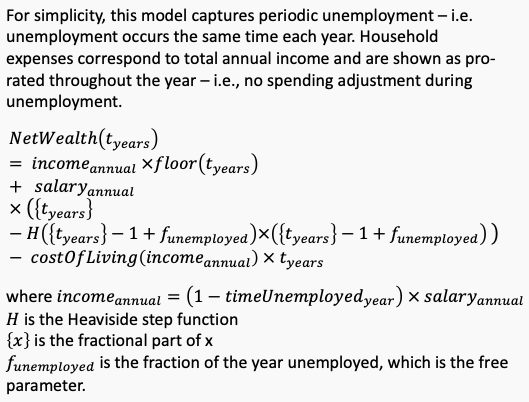

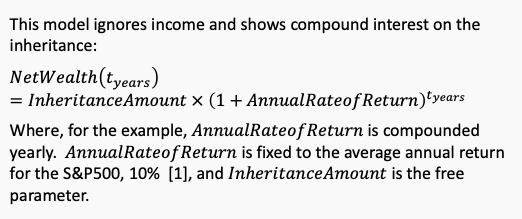

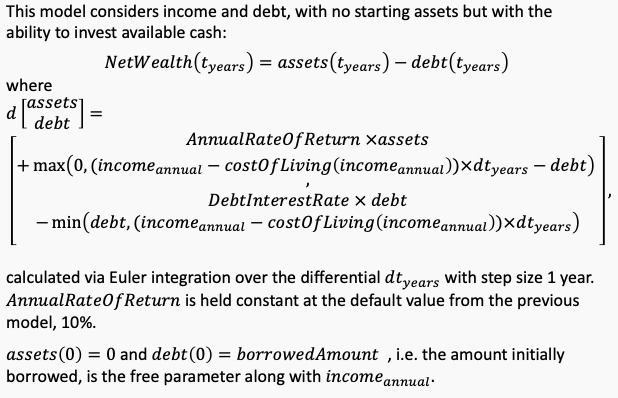

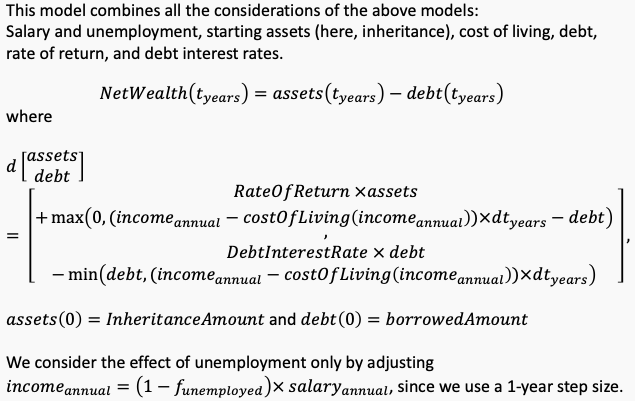

On this page, we walk through a simplified household finances dynamic model with a focus on how

racial inequity translates into the wealth trajectories of two residents, represented as the median

conditions of a Black D.C. resident and a White D.C. resident.

The term “dynamics” refers to the study of things in motion—in other words, how they change over time.

Bringing a dynamic perspective to studying the racial wealth gap means trying to understand its history

and future, in addition to its current state. Using a dynamic perspective rather than a static perspective

also helps us look at its structures and causes, examining what influences the wealth gap and how. This

model provides a way to understand the dynamics of the racial wealth gap by projecting household finances

forward in time, assessing whether the gap grows or shrinks when various contributors to the wealth gap

are adjusted. Though factors such as income, expenses, and interest rates change over time in the real

world, for the purposes of this model these factors are held constant to simplify the model and understand

general trends.

i

This page focuses on factors that impact household finances and the racial wealth gap and uses two

fictional personas: Nicole (a Black D.C. resident) and Lauren (a White D.C. resident), who both grew up in

and live in D.C. Other demographic and social factors also impact household wealth. Wealth gaps widen even

further, for example, when examining gender and race together. Once again, to simplify the model and

understand general trends, the example described here focuses specifically on race.

The page is broken up into sections, each of which discusses and models one of these factors. Nicole and

Lauren have been assigned the median values of several conditions impacting

household wealth for DC

residents of their respective races and are used as demonstrative examples throughout.

Follow along below to learn more about the factors that influence the wealth trajectories of these two

women using the interactive charts, which project changes in wealth over a 20-year period. The

accumulation of wealth is measured by net worth which is the sum of all the assets someone owns minus

their debts.

2

The cumulative effects of income (in the “Work Compensation” section) and expenses (in the

“Cost of Living” section) carry forward throughout the graphs and into the other sections. To see the

individual effects of employment security, inherited wealth, return from investments, and interest from

debt, click the box next to “equalize Lauren and Nicole's...” within each section. The final graph

displays the cumulative effects from the values inputted in all sections.